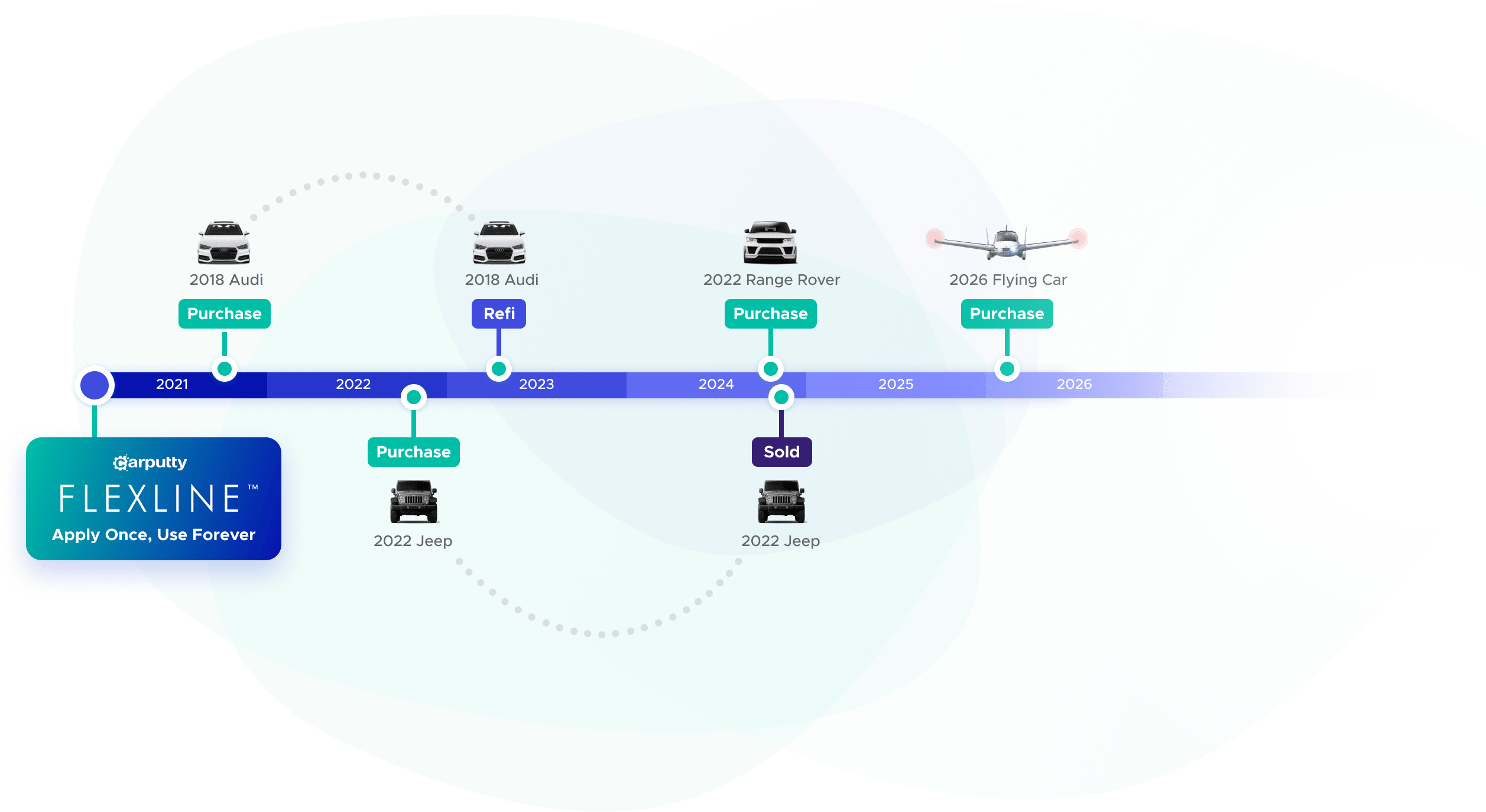

Apply for a line of credit in minutes—add and drop vehicles as you want. A more flexible way to fund your next purchase or refinance.

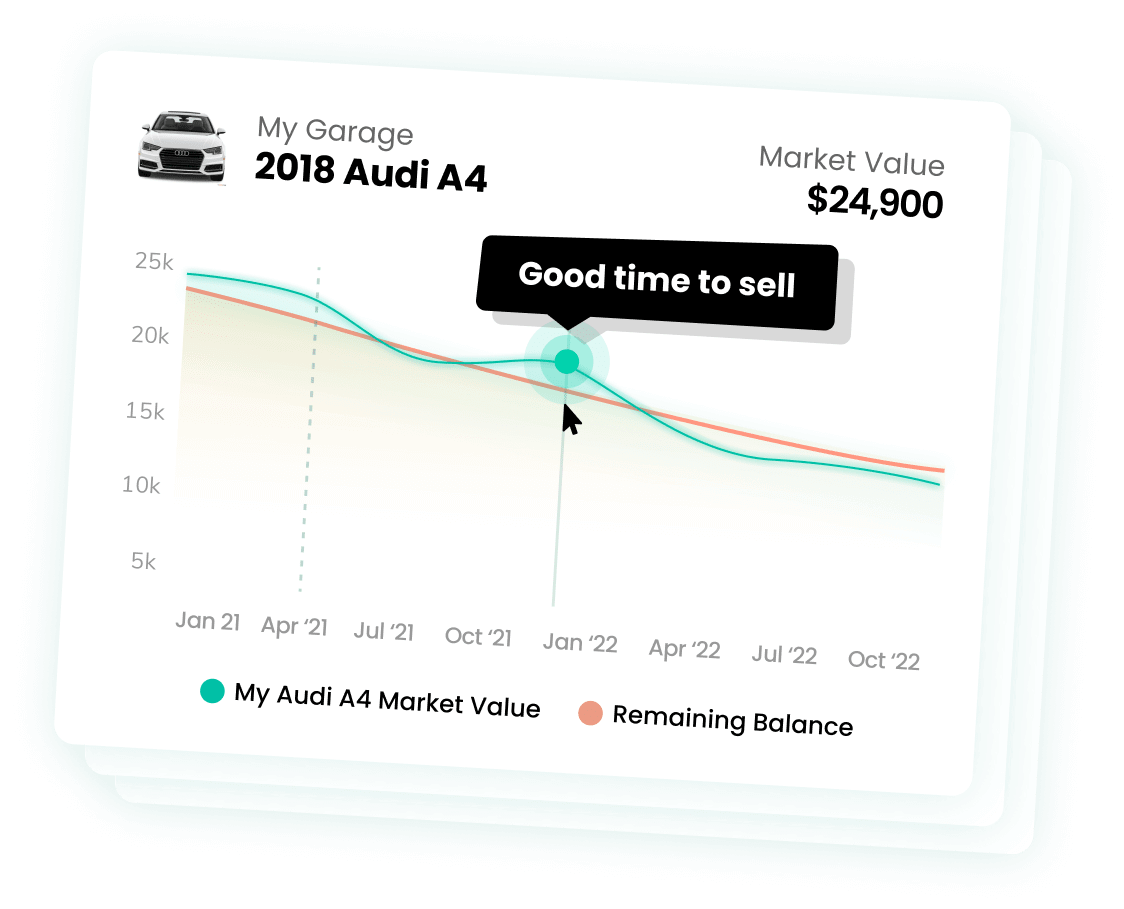

Our first-of-its-kind tool predicts the future value of every vehicle, so you always know the best time to buy and sell.

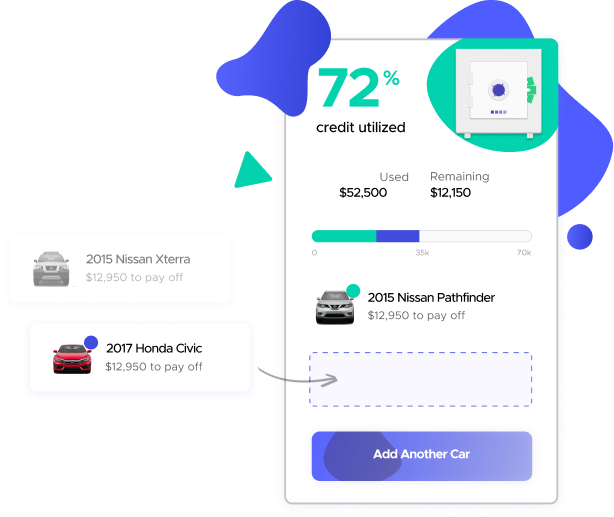

Manage your personal garage. Search for your next vehicle. We’ll even arrange for delivery or pickup when you buy or sell.

Carputty will credit you back the interest of your first 3 payments towards your principal balance. Just pay on time and pay off your car even sooner.

No need to reapply for a loan each time you want to make a purchase or refinance. That is how Carputty is perfect for drivers—not dealers.

A Carputty Flexline lets you shape your financing any way you choose. Now your loan is shaped to your life and not the other way around.

See coming dips and gains and chart your car against others in the market. It's free forever if you create an account.

A Carputty line of credit is tied to you—not a specific car. Once you’re approved, the money is yours. Use it when you’re ready, whether you’re buying today or not. More flexible than a loan, Carputty can provide financing for multiple cars, for as long as the line is open. So there’s no need to reapply if you’re in the market to buy.

Use your line of credit to purchase any vehicle, anywhere you want. Whether you’re working with a dealer, neighbor, friend’s uncle’s neighbor, buying out your lease, or simply refinancing—Carputty gives you the power of choice.

Unlike dealerships, Carputty never marks up rates. What you see is exactly the rate you’re getting based off of your credit.

Carputty tells you the current worth of your vehicle as well as future valuation, up to 5 years out. You can use this data to determine when the best time is to sell and get the most value out of your asset.

Your portfolio provides an overview of your outstanding balance vs. current/future vehicle valuations. It’s an easy way to see your assets and liabilities, all in one place.